In the world of credit cards, American Express, Visa, and MasterCard are like the three musketeers of the financial industry. But like any trio, even these three have differences that set them apart from one another. As a result, understanding the distinctions between them is essential in order to select the best one for your needs and lifestyle. So, let’s dive right in and learn about these companies.

In what ways are American Express, Visa, and Mastercard similar?

Before we jump into the differences, let’s see what is common between American Express, MasterCard, and Visa. These three are payment processing networks. Wait, what’s that? A payment processing network is an entity that enables credit or debit card payments. They act like an intermediary between your bank and the merchant to facilitate the transactions.

What are the key differences and perks of each network?

American Express

American Express, also known as Amex, is a financial

services company that offers credit cards, charge cards, and traveler’s checks. One of the biggest differences between American Express and other credit card companies is that American Express is both the issuer and the network. This means that they issue their own credit cards and process transactions through their network. They also set the terms, charges, and perks for their credit cards.

American Express offers credit card issuer rewards and bonuses in addition to network features like extended warranties, purchase protection, concierge services, and others. In comparison to others, they earn more points and bonus points. Since they engage directly with their consumers, American Express claims to provide consistent, high-quality customer service.

One of the main drawbacks of American Express cards is that their international acceptance rate is lower than that of Visa and MasterCard credit

cards. If you are someone who frequently travels, American Express won’t be an ideal choice in this case. Another con of these credit cards is that they typically come with higher fees and charges than other credit cards.

American Express offers a range of credit cards, including the Green, Gold, and Platinum cards, which all come with their own unique benefits.

Visa

Visa is a payment processing network that partners with banks and other financial institutions to issue credit cards, debit cards, and prepaid cards.

Unlike American Express, Visa does not issue its own credit cards. Instead, they partner with banks and other financial institutions to offer Visa-branded credit cards. This means that the benefits and fees of Visa credit cards can vary depending on the issuer.

Visa credit cards are accepted at millions of locations worldwide. You also have a wide range of options since banks or other credit card issuers partner with Visa and bundle rewards and perks to offer the cards to the public.

One drawback of Visa cards is that you can’t count on consistent service, fees, or incentives because these depend entirely on the financial companies issuing the cards and establishing their terms and fees.

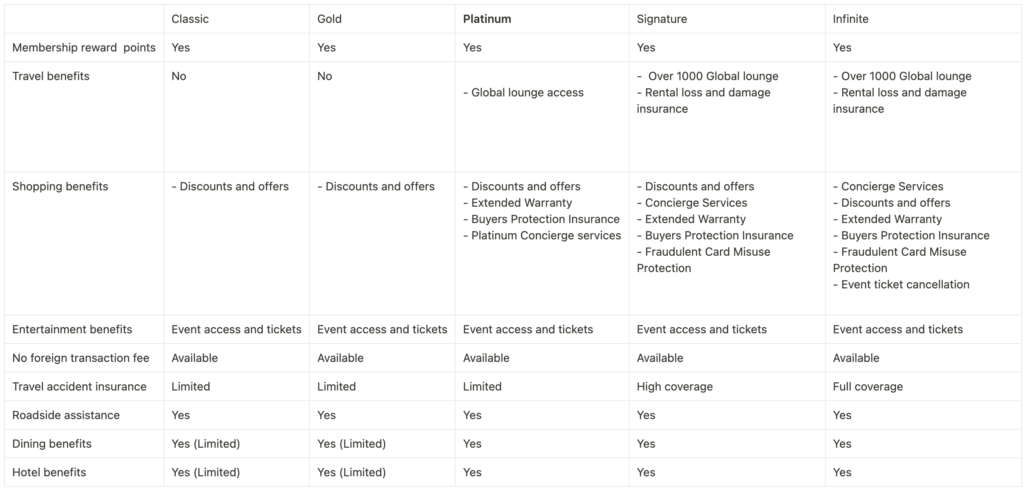

Visa offers three levels of credit card benefits: Classic, Gold, Platinum, Signature, and Infinite. Each level includes all the benefits of the levels below it. Here are some of the benefits offered at each level:

It’s important to note that specific benefits may vary depending on the issuer and specific credit card. It’s always a good idea to review the terms and conditions of a credit card before applying.

MasterCard

MasterCard is another payment processing network that is widely accepted around the globe. MasterCard and Visa cards are very similar in terms of the service, protection, and benefits offered.

Like Visa, even MasterCard does not issue credit cards; instead, it collaborates with financial institutions to issue cards. Hence, financial institutions decide on perks and fees.

MasterCard is the most widely accepted card around the globe, having acceptability in over 210 countries and territories, making it a convenient choice for travelers. As there are four types of MasterCards and numerous credit issuers, you have many more options to pick from. This ensures that everyone can choose the credit option that best suits them.

MasterCards are issued by financial institutions, which also set their own conditions and fees. So you cannot expect consistent service, fees, or incentives.

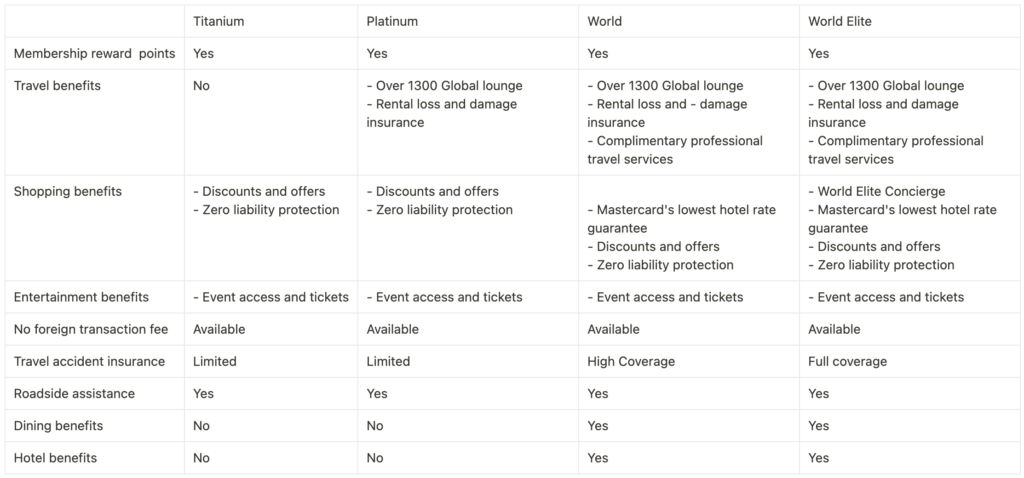

Standard and Gold Mastercard, Titanium and Platinum Mastercard, World Mastercard, and World Elite Mastercard are the four levels of MasterCard credit cards. Here are some of the benefits offered within Titanium, Platinum, World, and Word Elite.

The distinction between MasterCard and Visa is quite subtle, which is due to either insurance coverage, protection, or other less prominent factors. When deciding between MasterCard and Visa credit cards, the credit card issuer plays a greater role since they set terms, rewards, and charges.

Overall, all three cards offer similar benefits, such as airport lounge access and concierge services, but each has its own unique features and perks. The World Elite Mastercard and Visa Infinite are more focused on travel-related benefits, while the American Express Platinum Card offers a broader range of benefits, including travel, dining, and shopping. It’s important to consider your personal spending habits and lifestyle when choosing a premium credit card that’s right for you.

Now that we know the key differences, let’s find out who issues these cards in Bahrain.

American Express is the only company that issues Amex cards. There are many financial institutions in Bahrain that issue MasterCards and Visas. Check out the list below to find out where you can get your American Express, Visa, and Mastercard.

You can get American Express cards from:

- American Express MENA app or website

You can get MasterCard credit cards from:

- BisB

- CrediMax

- Standard Charted Bank

- ila Bank

- NBB

- HSBC

- CitiBank

- AIB

You can get a Visa card at:

- Al-Salam Bank

- KFH

- KHCB

- NBB

- BisB

- CrediMax

- CitiBank

- NBK

Daleel Takeaways:

- American Express is both the issuer and the network, while Visa and MasterCard work with issuers to offer credit cards.

- The benefits and fees of Visa and MasterCard credit cards can vary depending on the issuer, while American Express sets the benefits and fees for its own cards.

- Visa and MasterCard credit cards are accepted at more locations worldwide than American Express credit cards.